How to Choose the Right Trading Tools for Your Financial Goals

I. Introduction

Choosing the right trading tools is crucial for achieving your financial goals. With an array of different tools available, it can be overwhelming to determine which ones best suit your needs. This blog aims to help traders identify the optimal trading tools for their specific financial goals, by providing an informative and objective overview of the various options available.

II. Understanding Your Financial Goals

Setting clear and realistic financial goals is a crucial first step in choosing the right trading tools. These goals will guide your trading strategy and help you select the tools that best support your objectives. When determining your financial goals, consider the following factors:

Risk tolerance: Risk tolerance is the level of risk you’re willing to accept in pursuit of your financial goals. Understanding your risk tolerance will help you choose trading tools that align with your risk profile, ensuring that you’re comfortable with the level of risk in your trading activities.

Time horizon: Your time horizon is the length of time you plan to hold your investments before cashing out. A longer time horizon allows you to take on more risk, while a shorter time horizon may require a more conservative approach. Consider your time horizon when selecting trading tools, as it will influence the types of investments and trading strategies you employ.

Expected returns: Your expected returns are the profits you hope to achieve from your investments. Setting realistic expectations for your returns will help you select trading tools that can help you meet your goals. Be cautious of tools that promise unrealistic returns, as they may be too risky or unreliable.

Diversification strategy: Diversification is the process of spreading your investments across a range of assets to reduce risk. A well-diversified portfolio can help protect your investments from market volatility and improve your chances of achieving your financial goals. When choosing trading tools, consider how they can support your diversification strategy and enable you to effectively manage your portfolio.

III. Types of Trading Tools

There are various trading tools available to help you achieve your financial goals. These can be broadly categorized into trading platforms, technical analysis tools, and fundamental analysis tools. Let’s take a closer look at each category:

Trading platforms: Trading platforms are the software applications that enable you to place trades and manage your investments. They come in various formats, including:

- Desktop platforms are downloadable programs that provide a comprehensive trading experience with advanced charting tools, customizable interfaces, and a wide range of features.

- Web-based platforms can be accessed directly through your browser, offering the convenience of trading from any device without the need to install software.

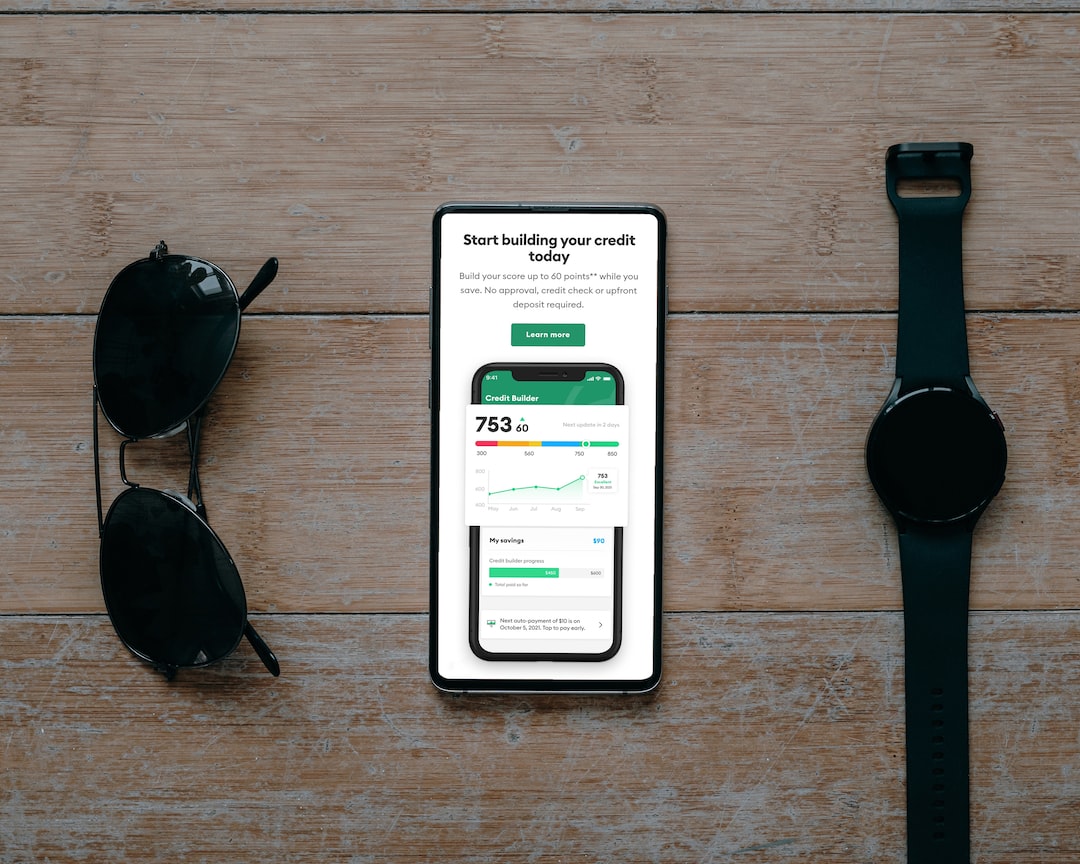

- Mobile platforms are apps designed for smartphones and tablets, allowing you to manage your trades on the go and stay connected to the markets.

Technical analysis tools: Technical analysis tools help traders identify trends and patterns in the market to make informed trading decisions. These tools include:

- Charting software allows you to visualize market data and analyze price movements using various types of charts, such as candlestick, bar, and line charts.

- Technical indicators are mathematical calculations that provide insights into market trends, momentum, and volatility. Examples include moving averages, relative strength index (RSI), and Bollinger Bands.

- Backtesting tools enable you to test your trading strategies using historical market data, helping you refine your approach and identify potential pitfalls.

Fundamental analysis tools: Fundamental analysis tools help traders evaluate the health of a company or economy by examining various financial and economic factors. These tools include:

- Financial news sources provide timely information on market events, company announcements, and macroeconomic trends that can impact your investments.

- Earnings reports and financial statements offer insights into a company’s financial performance, including its revenue, expenses, and profitability.

- Economic indicators are statistics that reflect the overall health of an economy, such as gross domestic product (GDP), employment data, and inflation rates. Monitoring these indicators can help you make informed decisions about your investments and trading strategies.

IV. Evaluating Trading Platforms

Selecting the right trading platform is essential for a smooth and successful trading experience. When evaluating trading platforms, consider the following features:

User interface and ease of use: A user-friendly platform with an intuitive interface can make trading more efficient and enjoyable. Look for platforms that provide clear navigation, helpful tooltips, and easy access to essential features.

Customization options: The ability to customize your trading environment can improve your overall experience. Platforms that offer customizable charting, watchlists, and trade execution settings can help you tailor your trading experience to your preferences and needs.

Commissions and fees: Be mindful of the costs associated with a trading platform. Some platforms charge fees for various services, while others offer commission-free trading. Consider how these costs may impact your overall trading performance and choose a platform that aligns with your financial goals.

Range of available assets: Ensure the platform supports the assets you want to trade, such as stocks, options, futures, or cryptocurrencies. A wider range of available assets allows for more diversification opportunities and flexibility in your trading strategy.

Customer support: A reliable customer support team can be invaluable when you encounter issues or have questions about your trading platform. Look for platforms with responsive customer support through various channels, such as phone, email, or live chat.

When comparing popular trading platforms, you may come across options like MetaTrader 4 and 5, Thinkorswim, E*TRADE, and Interactive Brokers. Each of these platforms offers a unique set of features and benefits, so it’s essential to research and test them to determine which one best suits your financial goals and trading style.

Finally, consider the following tips when selecting the best trading platform for your financial goals:

- Take advantage of free trials and demo accounts to test various platforms before committing.

- Read user reviews and testimonials to gain insights into the experiences of other traders.

- Ensure the platform is compatible with your preferred devices and operating systems.

- Consider the scalability of the platform as your trading skills and needs evolve over time.

V. Utilizing Technical Analysis Tools

Technical analysis plays a significant role in trading, as it helps traders identify market trends and make informed decisions. To effectively utilize technical analysis tools, consider the following aspects:

Selecting the right charting software: Charting software allows you to visualize and analyze market data, making it easier to spot trends and patterns. When choosing charting software, consider:

- Available chart types, such as candlestick, bar, and line charts, which can help you analyze price movements in different ways.

- Customization options, including the ability to modify chart colors, timeframes, and indicators, to tailor the software to your preferences.

- Integration with trading platforms, ensuring seamless communication between your charting software and your chosen trading platform.

Choosing the best technical indicators for your trading strategy: Technical indicators provide insights into market trends, momentum, and volatility. Selecting the right indicators for your strategy is crucial for successful trading. Consider the following types of indicators:

- Trend-following indicators, such as moving averages, help you identify and follow the overall direction of the market.

- Oscillators, like the relative strength index (RSI) or stochastic, can help you identify overbought or oversold conditions, indicating potential trend reversals.

- Volume indicators, such as the on-balance volume (OBV), provide insights into the relationship between price movements and trading volume, which can help confirm trends or signal potential reversals.

The value of backtesting tools in refining trading strategies: Backtesting tools enable you to test your trading strategies using historical market data. This process can help you refine your approach, identify potential pitfalls, and improve your overall trading performance. By incorporating backtesting into your trading routine, you can gain valuable insights and increase your confidence in your trading strategy.

VI. Making the Most of Fundamental Analysis Tools

Fundamental analysis plays a crucial role in assessing the health of a company or economy, helping traders make informed investment decisions. To make the most of fundamental analysis tools, consider the following aspects:

Identifying reliable financial news sources: Financial news sources provide timely information on market events, company announcements, and macroeconomic trends that can impact your investments. When choosing a news source, consider factors such as credibility, accuracy, and timeliness. Some reputable financial news outlets include Bloomberg, CNBC, and The Wall Street Journal.

Utilizing earnings reports and financial statements: Earnings reports and financial statements offer insights into a company’s financial performance. Key financial ratios to consider include price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio. Additionally, it’s essential to analyze a company’s balance sheet, income statement, and cash flow statement to assess its overall financial health.

Tracking economic indicators: Economic indicators are statistics that reflect the overall health of an economy. Major economic indicators to monitor include gross domestic product (GDP), employment data, and inflation rates. Understanding how these indicators can impact financial markets will help you make better-informed decisions about your investments and trading strategies.

VII. Conclusion

In summary, choosing the right trading tools is essential for achieving your financial goals. By understanding your financial objectives and carefully evaluating various trading platforms, technical analysis tools, and fundamental analysis tools, you can select the best resources to support your trading journey. Thorough research and testing of various tools before committing are crucial steps to ensure you find the right fit for your needs. Remember that as your financial goals and market conditions evolve, it’s essential to continually reassess and adapt your trading tools to stay on track and maintain a successful trading experience.

Check how our tools will help you precisely for ProRealTime, MetaTrader (or MT4) or TradingView platforms: